Regardless of the size of your property lawyer, it’s essential to know accounting basics to ensure that your dealings are compliant with ethics rules. This article presents property lawyers with some accounting tips and best practices for accurate and efficient accounting, along with the unique challenges to property lawyers.

1. Stay on Top of Trust Accounting

Trust accounting, a crucial aspect of accounting for property law, is keeping the funds your clients gave you in trust, including unearned fees paid as a retainer, court fees, settlement funds, or advanced costs, in a separate account from property lawyers’ operating funds.

Trust accounts are parts of the common areas of accounting for property lawyers to make errors because they have rules about what you can and can’t do with them. The penalties for breaking those rules can be severe, including disbarment.

Adherence to best practices is essential, or you may commingle funds and put yourself at risk. As rules vary from state to state, consult your region’s bar association and an experienced accountant to ensure you walk the right path.

2. Perform 3-way Reconciliations

Every region requires you to perform a 3-way reconciliation every month to 3 months between the trust bank account, individual client ledgers and trust ledger; A 3-way trust reconciliation involves the following:

Reconcile the Trust Account to the Trust Ledger

The trust ledger is similar to a chequebook register and should include trust transactions for your clients. You need to reconcile this trust ledger to the bank statement for the trust ledger account. There may be trust transactions in the catalogue at the end of the day, which will appear as outstanding items on your reconciliation. That is fine but look closely at the exceptional items to ensure they aren’t incorrect ledger entries.

Reconcile the Trust Ledger Account to the Individual Client Ledgers Account

While the trust ledger account includes all trust transactions for all clients, the individual client ledgers separate those transactions by the client. The sum of every client ledger must equal the balance in the prepared trust ledger. There should be no reconciliation or outstanding items because entries in the trust ledger and client ledger should happen simultaneously.

3. Set and Stick to a Budget

A property lawyer must set a budget to create expectations for expenses and cash flow and set revenue benchmarks. Usually, budgeting makes it easier for lawyers to set aside funds for larger expenses, such as legal research services, annual bar association dues, and information technology upgrades.

While there are several ways to establish a budget, you first need a strategy. Start by listing your mandatory expenses, such as rent, license fees, and utilities. Then, set achievable personal and business goals, such as if you wish to hire employees or contractors or how much time you want to take off for vacation. After projecting your income and revenue, you can determine what you need to do to attain your goals.

4. Ensure Solid Expense Reimbursements

It is a good idea to require all employees and partners to use a company credit card to ensure easy expense reimbursements; this makes tracking expenses for each client and partner easier and creates a direct paper trail. Reimbursable costs are known as advanced client costs.

5. Maintain Compliance with Clients’ Funds

Every property lawyer has a responsibility to stay compliant with ethics regulations. While ethics rules vary in all jurisdictions, there are basic commonalities when accounting for property lawyers. Whether through neglect or intentionally, violating compliance regulations, such as mishandling client funds, can lead to severe repercussions like suspension of your license, significant financial penalties, or disbarment.

7. Project Future Cash Flow

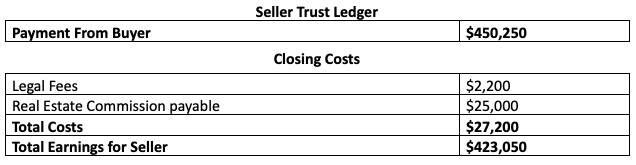

It’s essential to monitor your accounts receivable (A/R) ageing report to stay on top of outstanding invoices and follow-up. Your outstanding A/R will provide information on the cash you should receive shortly. It’s also essential for property lawyers to forecast when they expect to receive their shares of the proceeds.

8. Don’t use the Accrual Method of Accounting

Startup property lawyers need to select their unique accounting method, which must be done before they file their first tax return. You can go with the cash method or an accrual. Still, property lawyers are almost always personal service corporations (PSCs). They are, therefore, advised to use the cash method of accounting.

The cash method is better for taxable income with cash received, making it easier to settle the tax liability. You can adopt the cash method of accounting on the first return. If you have filed a tax return using the accrual method, you must file a request to change the cash method. Here is a summary of the cash and accrual methods:

- Accrual method: using the accrual method, you record your revenue when it is earned and expenses when you have incurred, whether you are paid immediately or not. That matches costs to revenues earned in a given month or year but doesn’t necessarily match income with cash flow.

- Cash method: Cash basis accounting recognizes revenue when you’re paid or when cash is received and expenses when they’re paid. Since revenue and cash flow are aligned, it’s generally easier to meet your income tax obligations than with the accrual method.

9. Simplify Financial Tasks With Accounting Software

While saving costs by taking care of accounting yourself may be tempting, accounting software will help you save time on administrative tasks and give insight into your firm’s financial well-being. The leading law firm accounting software will even help you manage clients’ trust accounts, monitor expenses and time spent on cases, and maintain records so that you can bill clients accurately.

You may also hire a bookkeeper who specializes in working with property lawyers if you’re looking for extra help in this department.

Final Thoughts

Understanding accounting best practices is crucial in managing your business as a property lawyer. Decisions about accepting payments, billing processes, and trust accounting form the foundation for a firm’s financial success. Therefore, it is critical to ensure that you follow these accounting tips and best practices to boost profitability, save time, and prevent potentially serious compliance issues.